Contents:

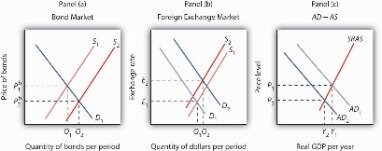

Order execution speed is around 0.25 seconds, all TP/SP will be executed normally. EUR/CHF trading remain on position close only basis until market liquidity is back. Would have been very expensive for the Swiss Franc to keep printing money to keep the exchange rate at 1.2 with the Euro when the Euro’s value has been reduced as far as it has.

The safest position to take in relation to EUR/CHF is to hold and observe. Yes, we know that the nuclear apocalypse is no longer upon us, but the solid proofs are still too fresh and few. The 1st quarter of 2020 will show where the Eurozone goes, where the US-China relationship go and hence, where the investor’s money goes. For now, the Swiss franc can celebrate freedom in a no-man territory. Consequently, the higher demand for CHF pushed its price up and kept solidifying it for the next four years against the EUR. That led to harder conditions for the Swiss exports as they make up to 70% of the country’s GDP and mostly have the Eurozone as their final destination.

In 2015, the world was slowly picking up the pace, although the crisis echo was still present in the Eurozone. To make things better, the ECB started planning the quantitative easing measures. That supposed that the SNB had to print even more francs to keep the 1.20 rate against the euro, which instigated the inflation fears among the Swiss economists. Coupled with the non-obviousness to maintain the peg with the possibly sinking ship of the European currency led to a logical but a very unexpected decision. Please note the price and sentiment information displayed in the chart is not real time and may have a delay of a few hours. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

EUR/CHF Analysis – New York Trading Session

Please read our Terms and Conditions and Privacy Policy for more information, and NFA’s Forex Investor Alert. When interest rates is increasing that is good for currency so you can expect price of EUR will rise. Why does it rise – because when there is high interest rate in country it attracts more investors who can benefit on high rates. This we call large spike where event made three or four times larger monthly pip range compared to “standard” monthly pip range.

- Around noon we see drop in pip range on the London session.

- On January 15, 2015, the Swiss National Bank announced the end of the EUR/CHF peg.

- When USD/CHF pair is going high EUR/CHF probably will go down.

- During overlap, news on the U.S. market are published which impacts all currencies in the world.

That day was the start of an uptrend, which EUR/CHF has not seen since 2007. With the freely traded Swiss franc, the EUR/CHF was now on a rising curve. However, as soon as it reached the historical level of 1.20, things turned dark again. January 15 is a well remembered date in the Forex world as it marked the decision of the Swiss banking authorities in 2015 to unpeg the Swiss franc from the euro. To many traders, the daily chart of USD/CHF is the best reminder of that day, although the story itself takes place between EUR and CHF. We have to state that some clients did lose their money yesterday due to this market disaster, however, their accounts weren’t closed in debt, thanks to our negative balance protection feature.

EURCHF chart

Here you’ll find what awaits the market this week, from the CPI release to a possible gold plunge. The trade war between the US and China kept the CHF appreciating against the EUR since the first part of 2018. On the daily chart, the marked downtrend is a local continuation of an overall larger decline since March 2018. That announcement was as unexpected as visible were its immediate results.

AMarkets is a global online broker, offering its services since 2007. Our mission is to provide clients and partners around the world with the opportunity to become successful in the financial markets. In the grand scheme of things, watching the EUR/CHF graphs flat-line for so long was never going to work. At one point it felt like the SNB were the only buyers of EURs in the market.

Explore more features and data

Citibank reported a huge loss of $150 million amid EURCHF flash crash. The event caused a huge $1 billion crash in world stock markets. Financial intuitions darned SNB for the EURCHF flash crash that caused significant losses everywhere the planet.

Similar to chart “EUR/CHF analysis – trading session pip range” this chart shows similar data on the pair volatility. This increase we can connect with waking of the market after weekend. On the chart above you can see that average monthly pip range is around 300 pips.

January 15 is expected to conclude that with both sides signing the Phase One trade deal. Based on that, the revived risk appetite of investors fortified the EUR against CHF. That’s why, despite the recent downswing, we see mostly sideways movement in the last months of 2019. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/CHF-bearish contrarian trading bias.

Friday – Day for Profit Lock

Price index is telling how the price of consumer goods and manufacturing material is doing. These prices have impact on inflation and consequently on interest rates. Countries with high level of inflation depreciate more compared to other currencies. Inflation causes the central bank to intervene in a way as adjusting interest rate to control undesired effects. Japan imports crude oil and natural gas products to satisfy domestic energy requirements. So, price of Yen is close connected with price of the energy commodities.

You will see further in this post on the chart how overlap time have impact on the pair volatility during the day. The London session gives us great volatility which is double than the Sydney session on some days in a week. https://day-trading.info/ Because the EUR is European currency, many traders love to trade this currency and consequently pair have higher volatility. AForex’s business as usual and clients may withdraw/deposit funds with no restrictions.

During overlap, news on the U.S. market are published which impacts all currencies in the world. On Sydney and Tokyo session you will have some volatility which can be enough for almost every strategy because pip range more than 50 pips is great. Moving from Asian session to European, London, session we see rise in pair volatility. Lets dive into EUR/CHF trading pair analysis to see how the pair behaves in different hour, day and month. I want to emphasize that the time of the candle price is taken out from the platform which is on GMT+1.

Which Trading Session Should You Trade

Again in December of 2008 SNB intervened by lowering target for three month Libor by 50 basis points to 0 and SNB started with transfer of non liquid asset from UBS to stabilization fund. 2015 had large impact on the market by news from EU where ECB decided to unleash QE(quantitative-easing). Drew Niv resigns as CEO of fbs is your reliable forex broker for the profitable online trading FXCM as forex broker changes name to Global Brokerage Inc. The following guest post is courtesy of Usman Ahmed at Investoo Group, which provides expert products for the financial trading industry. The following Infographic briefly describes the causes, events, market reaction and aftermaths pertaining to the CHF crash.

FOREX-Dollar slides as Fed rate hike outlook tumbles after SVB … – Nasdaq

FOREX-Dollar slides as Fed rate hike outlook tumbles after SVB ….

Posted: Mon, 13 Mar 2023 20:41:00 GMT [source]

Market action remains healthy so far in 2015 despite many unknowns including if the European Central Bank’s quantitative easing program will be tabled in a matter of days, and if Greece will remain in the eurozone. It’s a matter of trying to survive in the Wild West in the Swiss currency market this morning, and it used to be so cordial. Because the SNB set a floor of 1.20 for the CHF/EUR exchange rate meaning that the pair could move up, but not down – this is what all these 90% of traders were hoping for.

Slava Loza Forex Trader & Analyst By the way, it was really not the collapse, but a big rally, because the Swiss franc appreciated substantially that day. As I have give a lot of information in EUR/CHF analysis there is useful information you can use in your trading. June had spike on 2010 because of news from SNB about their intervention on the market. Learn more about our full range of powerful features including the best charts on the web. CommunityTantra Tantra and healing sexuality is all the rage these days. People are tired of the pornographic approaches to sexuality and they’re now looking for more inspiring methods of connecting with their lovers.

EUR/CHF Analysis Popularity

Please follow up with our news for trading conditions updates. Each firm is independent of the others and regulated separately. The Swiss franc rocketed past the euro overnight after the Swiss National Bank unexpectedly abandoned its cap on the CHF’s value versus the EUR. People realized that they will not have another opportunity to buy euros for francs like this, so they bought from everyone who wanted to sell. That’s exactly what happened at the level of 0,8 franc per euro, but only on a slightly smaller scale than in the example above.